Even micro-businesses—freelancers, consultants, solo online ventures, or family-run enterprises—can benefit from international strategies to optimize tax management, simplify bureaucracy, and operate in a straightforward and compliant way.

Contrary to common belief, access to simple and advantageous legal structures is not reserved for large corporations.

There are perfectly suitable solutions for those running small-scale businesses with global ambitions.

Micro Businesses

Smart Solutions for High-Efficiency Small Businesses

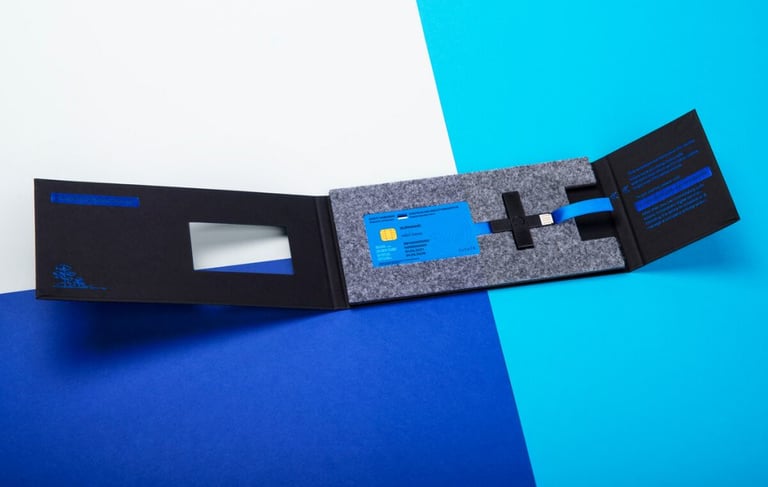

L’e-Residency estone è un programma unico al mondo, promosso dal governo dell’Estonia, che consente a cittadini non residenti di ottenere un’identità digitale ufficiale per costituire e gestire una società estone completamente online, da qualsiasi parte del mondo.

È la soluzione ideale per freelancer, nomadi digitali, startup, consulenti e microimprese che vogliono operare in Europa in modo legale, trasparente e snello, senza dover stabilire una residenza fisica.

What e-Residency Allows You to Do:

Establish an Estonian company (OÜ) entirely online in just a few days

Digitally sign documents with full legal validity

Manage accounting and taxation remotely

Open corporate bank or fintech accounts within the EU

Access Estonian and EU business services in an integrated way

Key Advantages:

Fully digital operation

Fair and transparent taxation (20% only on distributed profits)

No physical residence required in Estonia

Access to the EU single market (including EU VAT registration)

Strong reputation and international credibility

Ideal for digital businesses, services, consulting, and online sales

e-Residency in Estonia

The digital gateway to doing business in Europe wherever you are.

BVI Ltd

A Private Company Limited by Shares incorporated in the British Virgin Islands (BVI)—one of the world’s most renowned offshore jurisdictions for privacy, stability, and regulatory flexibility.

It is the preferred choice of entrepreneurs, investors, and consultants seeking a simple yet effective legal structure for international operations.

Key Features:

No local taxation on income earned outside the BVI

No public financial reporting or audit requirements

High level of confidentiality (shareholder data is not publicly accessible)

Fast incorporation, often within 24–48 hours

No minimum share capital required

Only one director and one shareholder needed (they can be the same person)

Common Uses:

Holding of shares or intangible assets

International trading

Management of rights, licenses, IP, or royalties

Investments in crypto assets or real estate

Neutral vehicle for joint ventures and mergers

Advantages:

No income or capital gains tax

Flexible and business-friendly legislation

International legal recognition

Ability to open bank or fintech accounts in various jurisdictions

Asset protection and easy transfer of ownership shares

BVI Ltd

A solid, private, and internationally recognized offshore corporate structure.

Gibraltar Ltd

Flexibility within a European framework

Gibraltar Ltd

A Private Company Limited by Shares incorporated in Gibraltar, a British Overseas Territory located in southern Spain, known for its business-friendly environment, English common law stability, and highly competitive tax regime.

Thanks to its strategic location, regulatory transparency, and low taxation, the Gibraltar Ltd is an ideal structure for entrepreneurs, investors, consultants, and digital businesses looking to operate legally within both the European and international landscape.

Key Features:

Taxation only on locally generated income: flat corporate tax rate of 12.5%, with 0% tax on foreign-sourced income

No tax on dividends, capital gains, or foreign interest

Based on UK company law (UK Companies Act): reliable and internationally recognized

Minimum requirement: 1 director and 1 shareholder (can be the same person)

No minimum share capital required

Suitable for operations in fintech, crypto, and e-commerce

Advantages:

Regulated and stable environment

More favorable reputation compared to many offshore jurisdictions

Access to corporate bank accounts with strong financial institutions

Fast incorporation and simplified management

Can be used as an operating company, holding, or investment vehicle

Contact Us

Do you have questions or need personalized advice?

We’re here to help you structure your business with tailor-made international tax solutions.

📞 Phone Contacts

🇬🇧 United Kingdom: +44 746 699 4615

📧 Email

info@onshorefreedom.com

💬 Direct Messaging

Prefer more private or immediate communication?

You can also reach us directly via:

Telegram: @onshorefreedom

WhatsApp: +44 746 699 4615

info@onshorefreedom.com

+44 74 66 99 46 15

Nantra LLP is the owner and manager of this website. As well as the logo and the brand OnShore Freedom and the domain name of the website ''onshorefreedom.com'' .

Nantra LLP © 2025. All rights reserved.

Nantra LLP, Company number NC001737,

Address: Unit 19 Antrim Enterprise Park, Greystone Road 58, Antrim, Northern Ireland, BT41 1JZ, United Kingdom.

UK VAT no: GB447880552 VIES VAT no: XI447880552

Freedom and financial indipendencefor your business.

Home NI LLP Tax Optimization Strategies UK Holding Jersey Trust Micro Businesses Services Who we are Contacts Privacy Policy Terms & Conditions